capital gains tax india

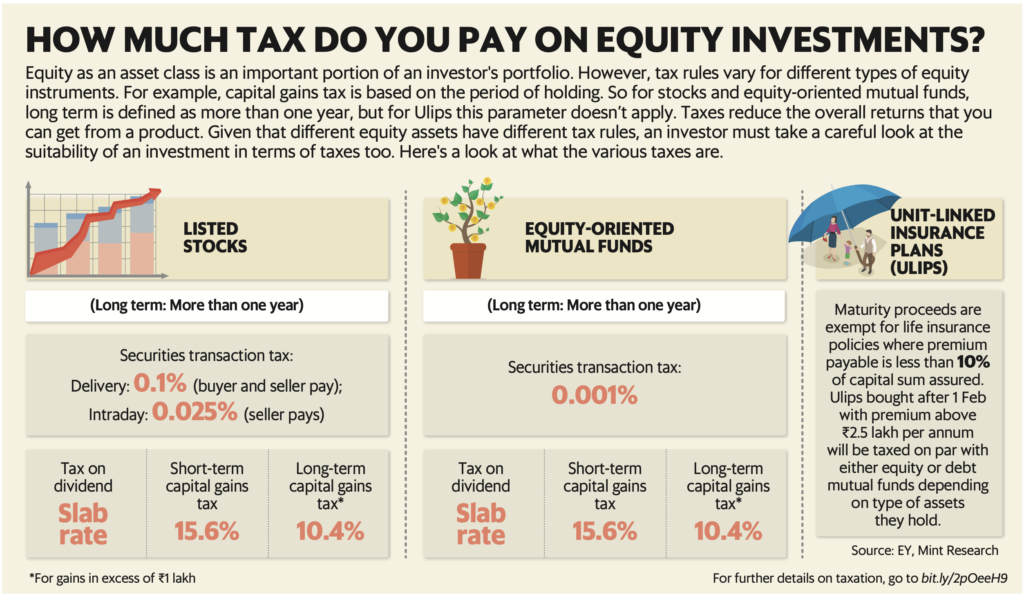

This tax is charged in the. The long term capital gains or LTCG on different equity mutual funds and on stock is taxed at the rate of 10 if there is any gain on the selling of any securities which are listed that.

How To Save Capital Gains Tax On Sale Of Plot Flat House

It will appear under the head income from capital gains and the tax will be charged accordingly.

. While STCG arising from the sale of. Capital Gains Tax Rate in India 2022 1 week ago Jan 26 2022 Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. Under Section 80C of the Income Tax Act the short-term capital gains attract a capital gain tax at a rate of 15.

In the case of a property profits earned by selling it within 24 months attract Short-term capital gains STCG and selling it after 24 months attracts the LTCG tax which is. Capital gains tax in India Important rules to be aware of. Real estate properties come under the category of capital assets.

Since the equity was held for 5 years it is considered as Long term capital gain and is taxed at 10 of the gain. If you are a resident Indian of 80. Capital assets are investments like house land stocks mutual funds jewelry trademarks etc.

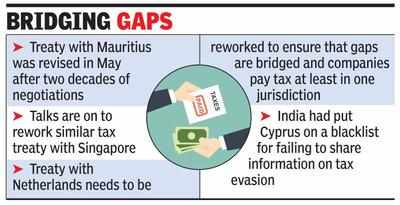

1 lakh is paid as capital gains tax. The India section covers parliament passing budget proposals and discusses no beneficial ownerships requirements are needed for capital gains tax exemption. Such taxation is incurred when investors decide to sell an asset within a year.

In India tax on capitals gains depends on two factors. Capital gains tax is the government-determined tax that has to be paid on the profit from the sale of an asset. Income from capital gains is classified as Short Term Capital Gains and Long Term Capital Gains.

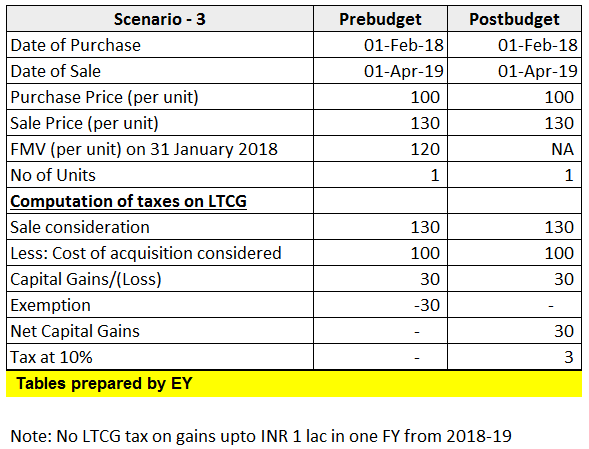

Effective 1 April 2018 long-term capital gains arising on transfer of equity shares in a company or a unit of equity oriented mutual fund or a unit of business trust on which STT has. The responsibility to pay capital gains tax arises on sale of a. Besides this the both.

These can attract long-term capital gains tax in India after 12 months to 36 months of ownership depending on the type of the property. Tax saving us 80C to 80U is not allowed to Capital gains. The tax paid is known as capital gains tax and there are two types of capital gains short-term capital gains tax STCG and long-term capital gains tax LTCG.

3 rows The tax laws in India are very comprehensive. Long-term capital gains are not taxed up to INR 100000. People who make short-term capital gains are taxed at 15 under Section 111A of the Income Tax Act 1961.

Capital gains are profits or gains made from selling a capital asset. First the nature of the capital asset and second the period for which it has been held. To know how to save Long Term Capital Gain Tax you first need to know your basic tax exemption limits based on your age and residency status.

Akin to Section 112A Section 111A specifies the rate of capital gain tax to be. And therefore after selling the properties you need. Gain arising on transfer of capital asset is charged to tax under the head Capital Gains.

This Tax on the Capital Assets is termed Capital Gain Tax. 4 rows Section 111A. The income tax on.

Capital gain is any profit or gain that occurs from the sale of a capital asset. Tax on Long-term Capital Gain. The tax that is.

There are different sections and provisions in the. The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1lakh and the STCG are taxed at 15. Tax Breaks under section 80c to 80U is not available to Capital gain.

How To Calculate Capital Gains On Sale Of Gifted Property Examples

What S Your Tax Rate For Crypto Capital Gains

Capital Gain Tax And Its Exemptions

Capital Gains Tax Capital Gains Tax In India Its Types Rates Calculation

Capital Gains Tax In India An Explainer India Briefing News

How To Save Capital Gain Taxes In Real Estate

How Are Capital Gains Taxed Tax Policy Center

Ltcg Tax Budget 2018 How Ltcg Tax On Shares Equity Mf Units Will Be Calculated As Per Proposed Rules

How To Save Capital Gain Tax On Sale Of Residential Property

How India Tax Investments In 2021 23 Most Common Investments Explained Apnaplan Com Personal Finance Investment Ideas

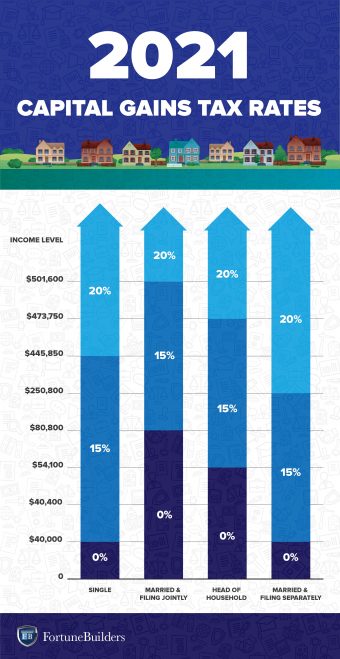

Real Estate Capital Gains Tax Rates In 2021 2022

Grandfathering Long Term Capital Gain On Stocks Equity Mutual Funds With Calculator

Capital Gain Tax Ltcg Stcg Tax Rates Types And Calculation Process Tax2win

Capital Gain Bonds Nivesh Sahayak

Managing Capital Gains Taxes While Transferring Properties Wealthymatters

Investments Via Cyprus To Attract Capital Gains Tax Times Of India

Capital Gains Tax The Long And Short Of It Mymoneysage Blog

How Are The Gains From Foreign Stocks Taxed In India Quora

Budget 2022 Will Capital Gains Tax Be Rationalized Across Asset Classes