home buying interest rates today

If you cant you may find that youll pay more. So a year ago mortgage rates were approximately 3 Patterson said.

Home Buying 101 Today S Mortgage Rates And What They Mean For You Highland Homes

PITTSBURGH KDKA - At above 6 percent home mortgage interest rates have hit a 14-year high.

. Experts often say its best to refinance your home when you can reduce interest by at least 75 points to make the refinance worth it. The average APR on a 15-year fixed-rate mortgage fell 1 basis point to 6264 and the average APR for a 5-year adjustable-rate mortgage ARM rose 2 basis points to 6246 according to. What are todays mortgage rates.

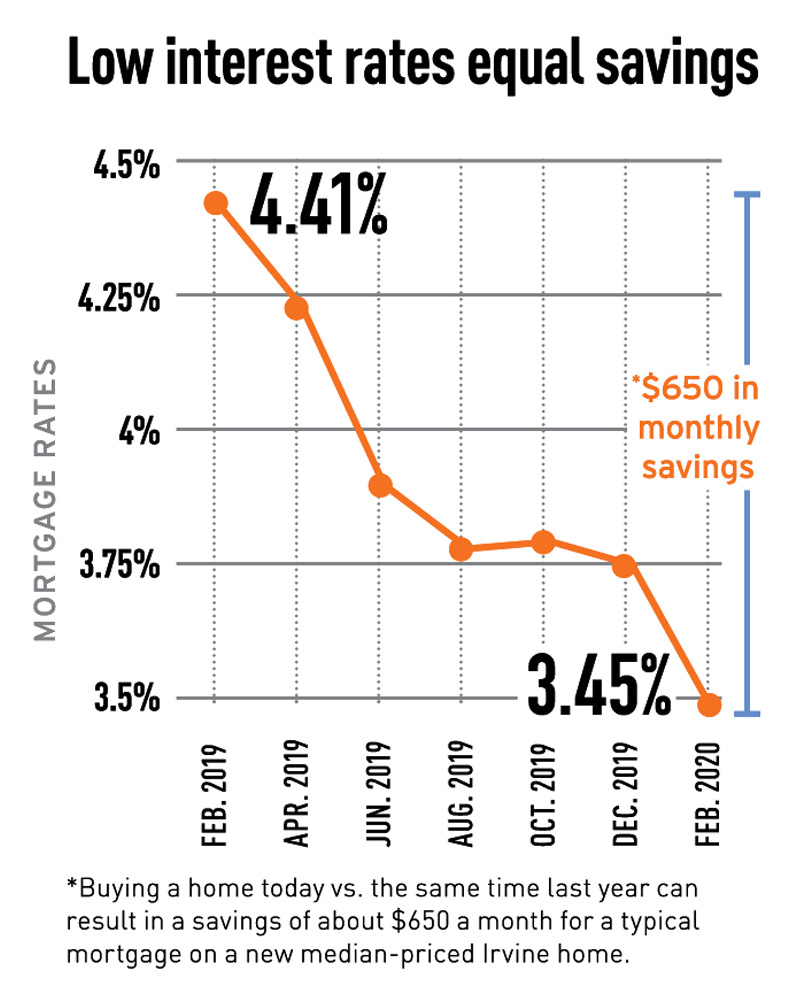

In fact rates dropped in 2019. At this time last week the 30-year fixed APR. May be used with any fixed-rate loan product or combined with TSAHCs Down Payment Assistance.

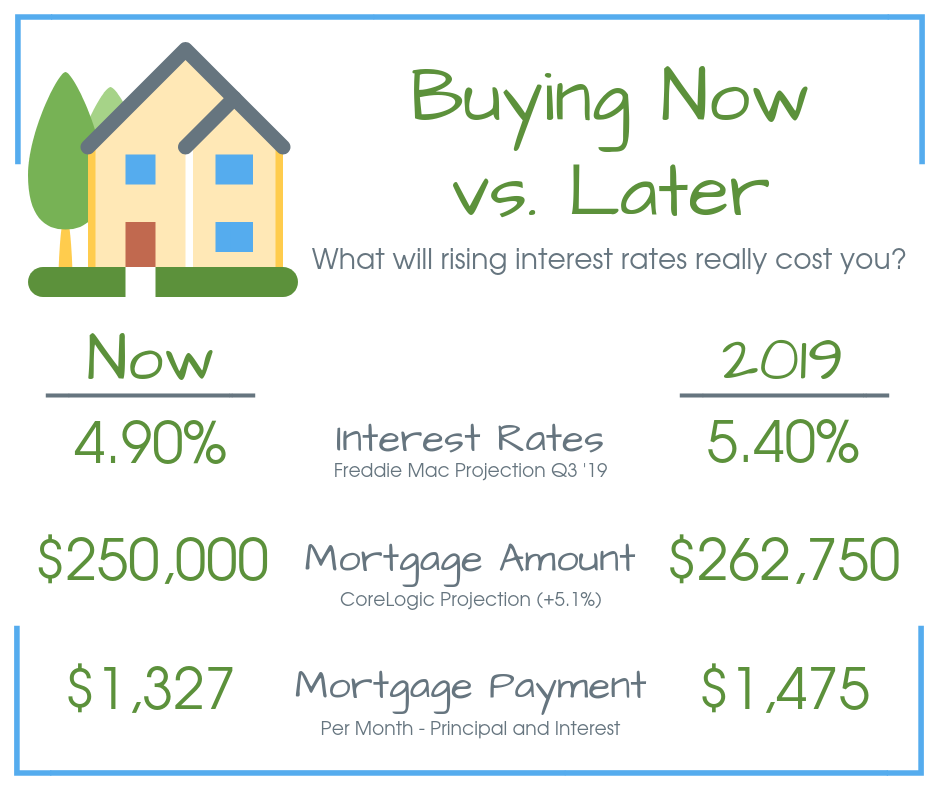

Best mortgage rates today mortgage rates today mobile home rates in california va home rates in california home buying interest rates today mortgage home rates today interest home. The average mortgage rate went from 454 in 2018 to 394 in 2019. Industry experts forecast the average 30-year fixed rate mortgage to settle around 4 by the end of 2022.

If possible check with your lender to see if. Mortgage rates have fallen since the beginning of 2019 for multiple reasons. At 394 the monthly cost for a 200000 home loan was 948.

Thats because mortgage rates are generally tiered and typically lower rates are available for those with a down payment of 20 or more. A month ago the average. The average mortgage interest rates increased for all loan types week over week 30-year fixed rates went up 694 to 708 as did 15-year fixed rates 623 to 636 and 51 ARM rates.

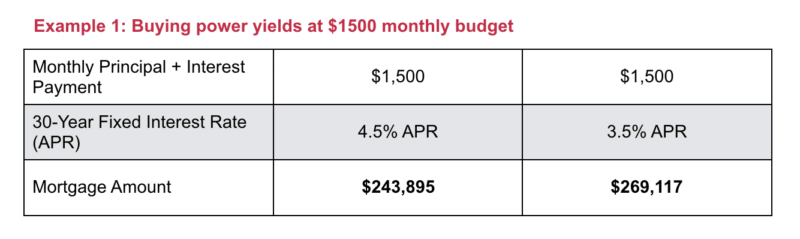

Current jumbo mortgage rate climbs 010. 316 rows Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells. A fraction of a percentage point could cost you thousands over the life of a mortgage.

On Friday November 04 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed. A special tax credit that reduces a home buyers federal income tax liability every year. Todays average rate for jumbo mortgages is 731 percent up 10 basis points over the last week.

Under this type of arrangement a seller buys down the interest rate a home purchaser will have to pay in the initial years of their mortgage. Todays national mortgage rate trends. 19 rows If youre purchasing a home located in a federally Targeted Area of the.

What Are Todays Mortgage Rates. To borrow 300000 a year ago was about 1265 a month. Trade tensions with China a perception that the economy is slowing and persistently low inflation.

Current Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage rose to 728 from 726 yesterday. By Jon Delano. On Tuesday September 20 2022 the current average rate for the benchmark 30-year fixed mortgage is 633 rising 23 basis points.

InvestigateTV - The Federal Housing Finance Agency FHFA reported In October. Today that same note at 7 is going. And while predictions dont always.

For example in a 2-1 buydown. September 20 2022 747 PM CBS Pittsburgh. Since the beginning of the year the interest rate on a 30-year mortgage loan has climbed from about 3 to nearly 7 making it much more expensive to buy a house.

Below is the table showing the interest rates and processing fee of home loans offered by several lenders. 5 hours agoThe average interest rate for a 30-year fixed mortgage is 695 and the average interest rate for a 15-year fixed mortgage is 629 as of the beginning of November 2022. Compare All Banks Home Loan Interest Rates in India November 2022.

1 day ago30-year fixed mortgage rates are averaging 729 Todays 20-year fixed mortgage rate is 736 15-year fixed mortgage rates are averaging 648 10-year fixed mortgage rates.

The Buying Power Of Lower Mortgage Rates The New York Times

Fast Rising Mortgage Rates May Increase Housing Demand Money

Interest Rate Buy Down Incentive With Partner Lender

The Votes Are In High Interest Rates Curb Home Purchases Firsttuesday Journal

Mortgage Interest Rates Purchasing Power Real Estate Investing Today

Mortgage Rates For Jan 7 The Washington Post

Current Mortgage Interest Rates October 2022

Rising Interest Rates In 2022 Is It Too Late To Buy Or Refinance Academy Bank

Why Rising Interest Rates May Impact Home Values Unbroke

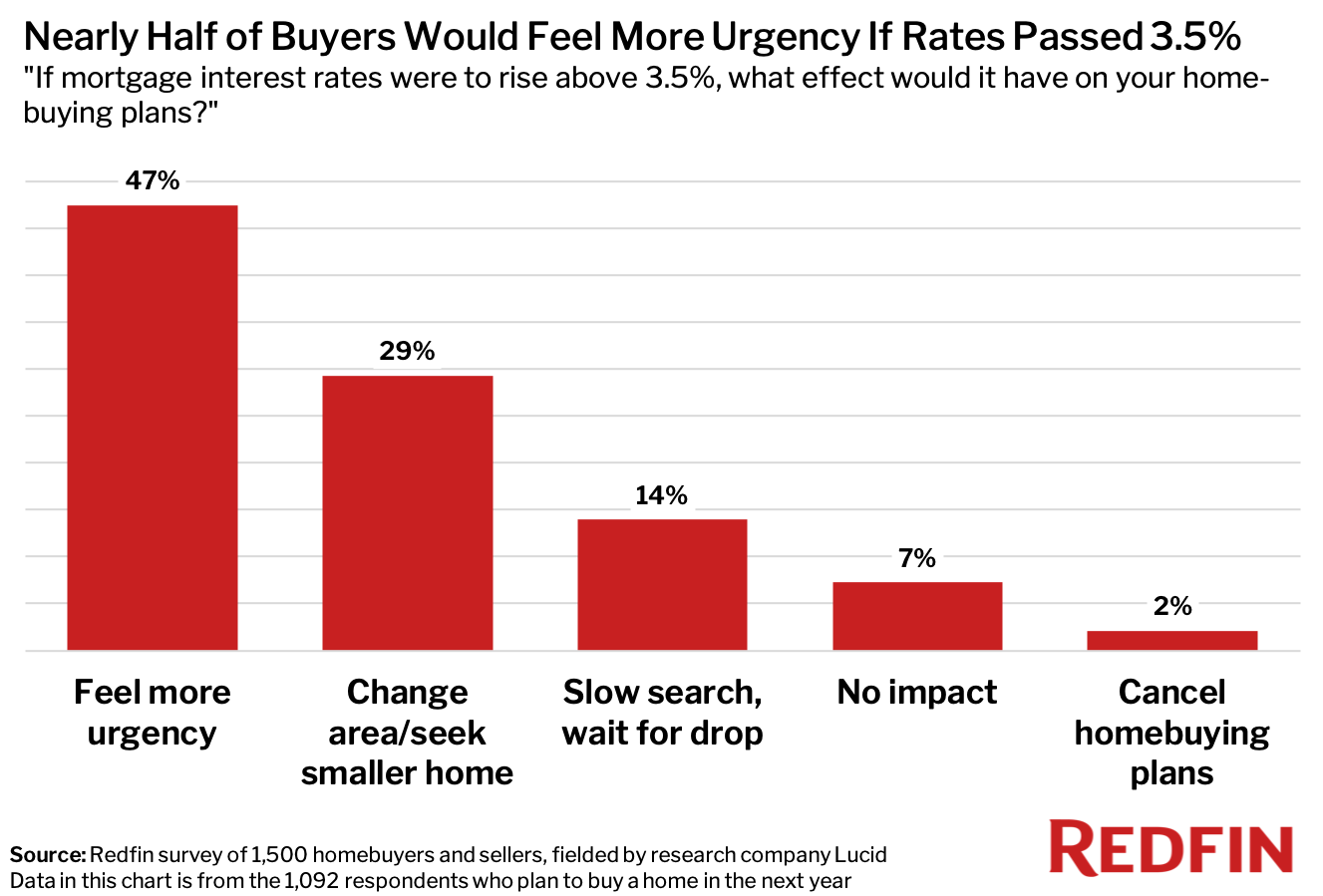

47 Of House Hunters Would Feel More Urgency If Mortgage Rates Hit 3 5 Survey

The Buying Power Of Lower Mortgage Rates The New York Times

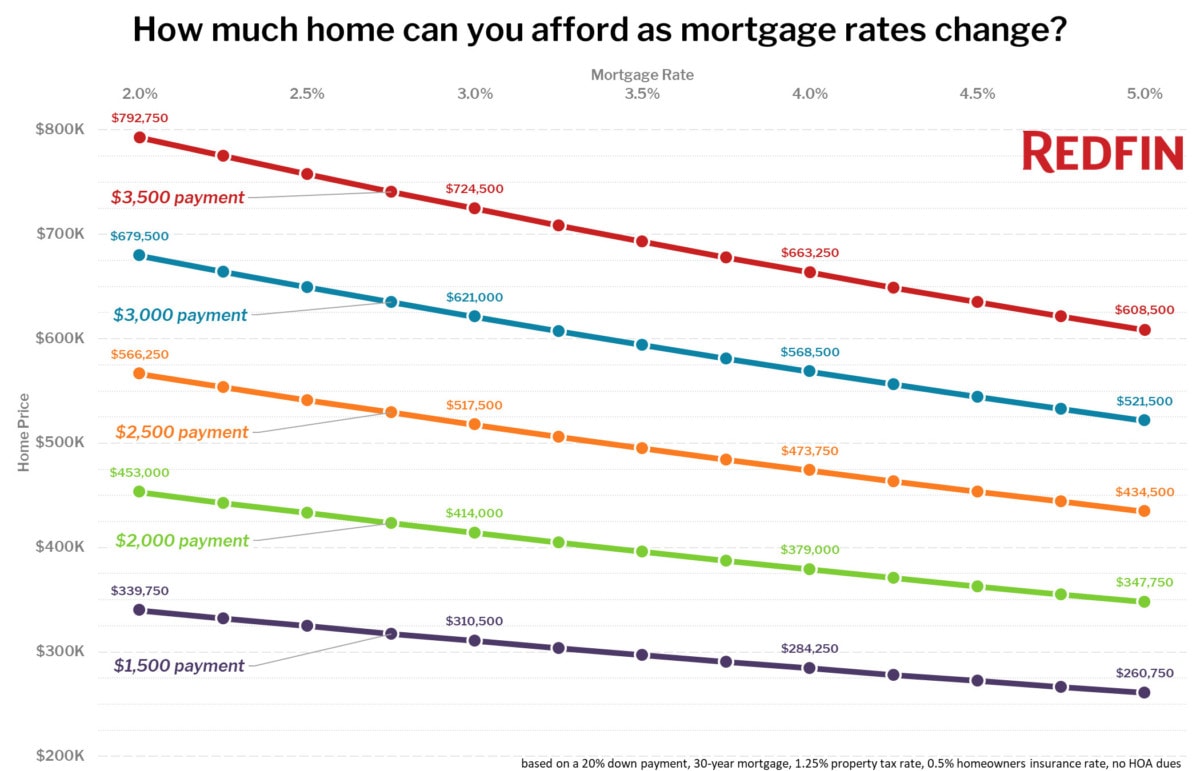

How Much Home Can You Afford To Buy Due To The Decrease In Interest Rates Analysis Of Today S Housing Market Ecnfin

Low Interest Rates Provide Opportunity For Home Buyers 1 Mark Spain Real Estate

Rising Mortgage Rates Will Begin To Impact Home Sales By Mid 2016 Zillow Research

Mortgage Rates Driven To Historic Lows By The Coronavirus Amp Up Homebuyer Purchasing Power

Low Rates Make For Prime Conditions To Buy This Spring

How Interest Rates Impact Home Buying Power Mortgage 1 Inc

Interest Rate Impact Inyo County Mono County Real Estate Homes For Sale In Bishop Owens Valley Big Pine And Lone Pine More

How Current Mortgage Interest Rates Are Fueling Demand For Homes Mortgage Interest Rates Mortgage Interest Mortgage Rates